Benefits

Introducing your new Benefits Service Center!

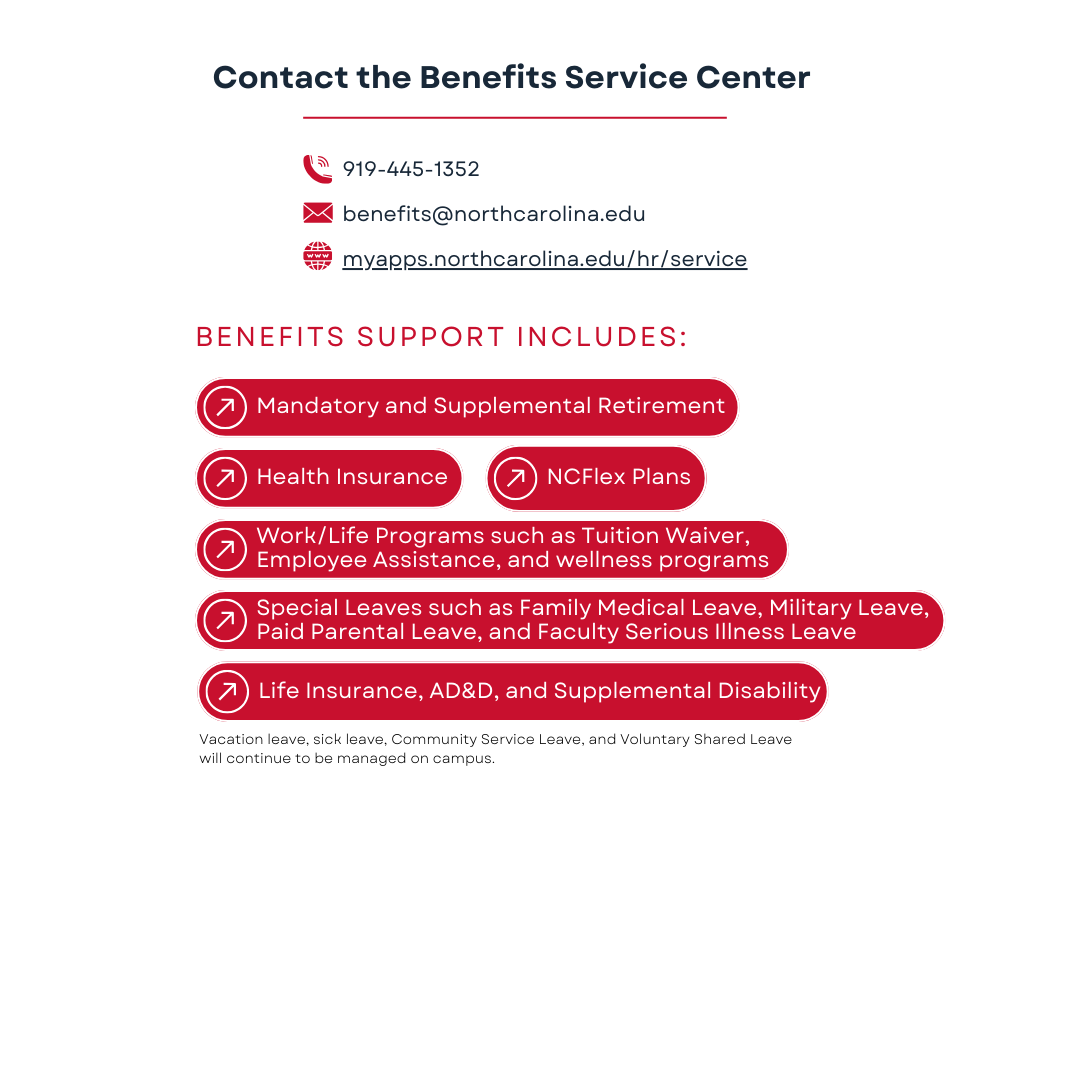

WSSU staff and faculty will now receive benefits counseling and support through a new, centrally based Service Center. You will have easy access to the experienced Service Center staff, who will provide knowledgeable service and initial responses within one business day.

Service Center staff will offer counseling and support for all employee benefits except vacation and sick leave, community service leave, and voluntary shared leave, which will continue to be managed here on campus.

You will have easy access to Service Center staff via email, video meetings, opportunities for in-person meetings, phone calls, and fax, plus workshops, including open enrollment and retirement preparation.